A Guide to Taking a Digital-First Approach for Financial Institutions

Introduction

Powering your financial institution with innovative fintech is necessary to grow and retain your consumer base. By providing accessible, seamless experiences with modern digital solutions, consumers can stay engaged with products and services from the comfort of their own homes or on the go. Read on to learn what process can be automated to increase efficiencies, and how to decide what's right for your financial institution.

Digital Experiences

The goal in providing digital experiences for financial institution consumers is ease of interacting with banks and credit unions and their products and services. Digital solutions allow consumers fast access to satisfy their needs via internet-connected mobile devices while simultaneously streamlining internal operations.

What is a Digital-First Approach for Financial Institutions?

With a digital-first strategy, banks and credit unions stay more competitive by allowing consumers to control their own experiences with online and mobile-friendly solutions which are typically accessible 24/7.

With a digital-first strategy, banks and credit unions stay more competitive by allowing consumers to control their own experiences with online and mobile-friendly solutions which are typically accessible 24/7.

Offering adaptable products and services that are made to fit all needs draws consumers to you over other financial institutions with less flexible options.

A digital-first approach improves consumer experience management (CXM) by delivering exceptional experiences through any channel with safe, secure, easy-to-use solutions.

How to Build Your Own Comprehensive FinTech Ecosystem

A seamless FinTech ecosystem is a mix of your software, solutions, and/or programs that integrate with each other for seamless experiences.

For example, a consumer can schedule an appointment on your website through a chatbot conversation and then check-in via kiosk and be authenticated digitally with face ID or fingerprint from their own mobile device when they arrive for the appointment.

To avoid disjointed experiences with your digital solutions, it is important to ensure compatibility wherever possible, providing consistent and smooth experiences for consumers. This differentiates financial institutions from others in the market while enabling integration on the back end, meaning all data is stored properly.

Now, let’s look at different types of digital solutions that help banks and credit unions modernize and simplify consumer experiences.

Easily Manage Appointments and Lobby Check-Ins

With 60% of U.S. consumers preferring automated self-service options, financial institutions must start adopting the most modern scheduling options available.

Along with reducing wait times and freeing employees to focus on important matters, consumers are enjoying (and demanding) more control over their financial interactions via self-service technology. Automated appointment scheduling software delivers effortless experiences for bank and credit union consumers.

Appointment management is developed to be simple to use and requires minimal onboarding time. It offers skill-based routing, outlook integration, kiosk or mobile check-in options, and a customizable website widget.

The system automatically assigns representatives based on their service skills and calendar availability. Automated reporting provides proactive engagement insights to inform future strategic operational decisions.

Integrated Services

Integrated services provide seamless experiences for customers and increase operational efficiency by eliminating silos and duplicative processes. An integrated digital service strategy also allows for a comprehensive view of the consumer, enabling financial institutions to make informed decisions and provide personalized financial services.

Connect Consumers to Their Accounts with a Digital Banking Platform

A digital banking platform can simplify your operations and offer your consumers modern self-service features that let them access their accounts from anywhere, anytime.

This core-agnostic, open-architecture digital banking platform offers connected experiences for financial institutions and their consumers.

Taking on your financial institution’s brand personality, NCR’s digital banking platform acts as a function-rich, highly tailorable, and API-driven solution that can help financial institutions lower their costs, decrease complexities, and increase the speed of innovation.

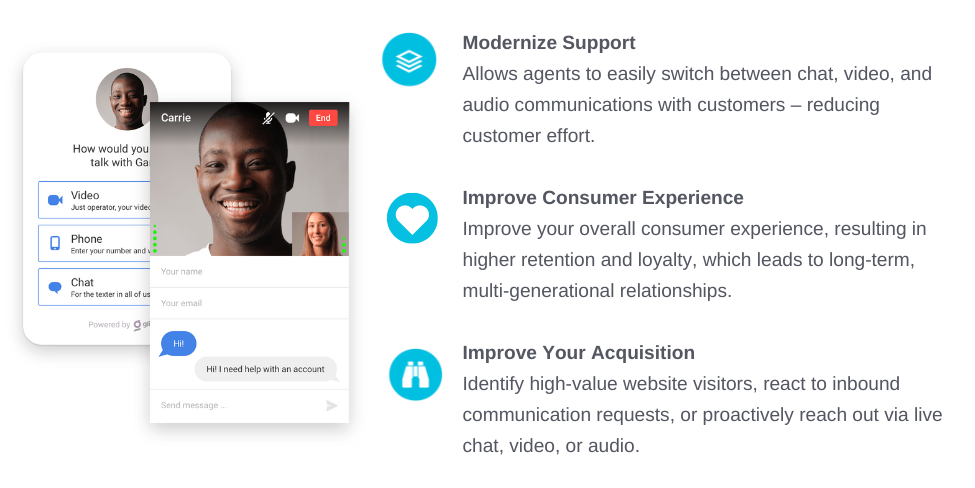

Give Consumers More Control Over Their Experience with a Digital Customer Service (DCS) Platform

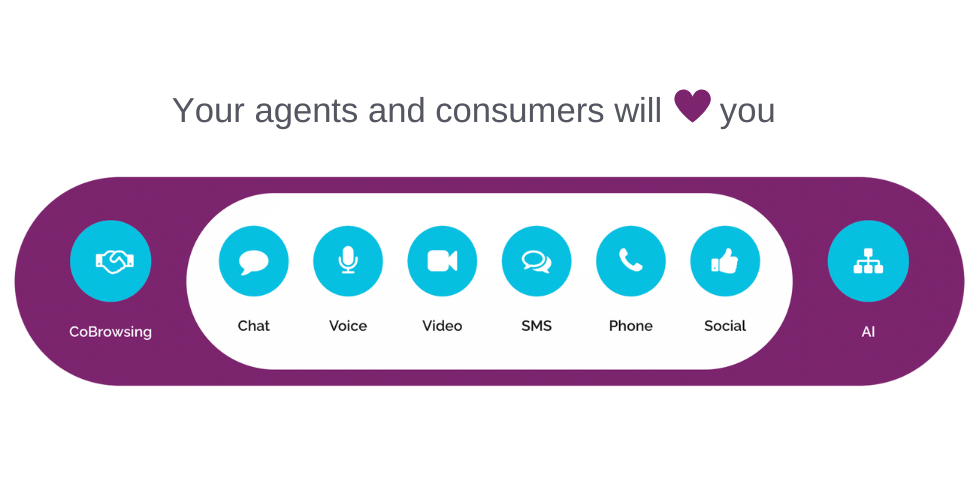

Offering consumers a sleek, user-friendly way to access support, products, and services from their mobile devices is a vital way to approach a digital-first strategy.

With a digital customer service solution integrated with your bank or credit union, consumers can receive support through multiple different channels.

Gain Vendor and Core Independence for Your Financial Institution

Gain Vendor and Core Independence for Your Financial Institution

With an API-led integration hub, the power to integrate your core and any key solution is at your fingertips.

An open API banking strategy gives banks and credit unions digital freedom to choose who they want to work with by ending point-to-point integrations that slow progress, are costly, time-consuming, and limiting.

FTSI’s partnered API platform acts as a FinTech hub, placing the power to progress your vision, advance at your pace, consolidate costs, and puts control of your technology experiences where it belongs: in your hands.

What are APIs?

APIs are sets of software intermediaries that allow two or more programs to exchange information bidirectionally, or “point-to-point.”

APIs are already common in financial institutions’ software stacks, but the problem with having these integrations without a dynamic strategy is the need to manage several, overly complicated, redundant, and independent point-to-point connections that don’t communicate with each other.

What is an Integration Platform as a Service (iPaaS)?

In the same way that Software as a Service (SaaS) has taken off over the past several years, Integration Platforms as a Service (iPaaS) are following suit. Simply put, iPaaS acts as the central hub for APIs and integrations; a FinTech hub. This type of integrative platform is the next iteration of the API revolution.

A platform to centralize APIs provides financial institutions with standardization on how applications are integrated into their organization, creating consistent connections that can be reused in the future to save time, money, and developer resources.

A dynamic FinTech hub provides financial institutions with integrative open banking tools that can unlock access to their banking core data, eliminate dependencies on third-party vendors, and simplify connections to applications and real-time payment networks.

How is this Helpful to Financial Institutions?

The implementation of a FinTech hub gives financial institutions the power to break away from point-to-point solutions and allows them to be agile with their innovation and integrations. With the ability to establish and easily reuse connection pathways, financial institutions do not have to rely on vendor or developer resources or limitations.

This means that once an integration strategy and initial connections are established, financial institutions can reuse and iterate off their initial APIs, so they can deploy new solutions in days rather than weeks or months, and without the need for outside resources to do the heavy lifting.

FinTech hubs are also being adopted to improve internal systems to streamline and automate manual or inefficient processes, such as change of address for contacts.

Use Case for API Integration for Financial Institutions

This year, Gulf Winds Credit Union partnered with FTSI and PortX to establish an API strategy and implementation.

Their first integration project connected members with a third-party lending platform, which now provides members with an instant loan offer without leaving the Gulf Winds online portal.

Because the FinTech hub allows Gulf Winds to exchange information with their lending offer platform, members can fill out their information and receive an instant loan offer under the Gulf Winds website without being redirected, making for a consistent user experience for members.

Additionally, if Gulf Winds chooses a new vendor in the future, they may simply reuse the already-built connection(s) from this project, reducing cost, saving weeks of time, and removing the need for developer time and resources.

Join our guest speakers from Gulf Winds Credit Union and PortX, the minds behind the coding-optional FinTech hub, as they discuss this recent partnership and how a new API integration architecture provides smooth, connected experiences for their members seeking instant loan offers.

FTSI’s partnered FinTech hub solution integrates with our other digital solutions for seamless consumer experiences.

Supporting content

Custom Solutions

Financial institutions may require custom digital solutions in order to manage complex financial operations, meet the evolving demands of their customers, and stay ahead of the competition in the fast-paced digital and FinTech economy. By leveraging available technology to streamline processes, enhance the customer experience, and improve decision-making, financial institutions can improve their operational efficiency and remain relevant in an increasingly digital world.

Go Beyond Digital Banking with App Development

Should your financial institution have a customized mobile app for your consumers? Sometimes, a mobile banking platform is not enough to make the most of your products, services, offerings, and unique brand.

At FTSI, we believe in providing community financial institutions with a robust ecosystem of innovative technologies. We use strategy, design, and continual support to lend the helping hand your organization needs.

Our FTSI App Development Team uses a mix of D4 and Design Thinking to discover your concept, strategically design its consumer experience, develop it with best practices and deploy your app to the world.

We approach each project with focused attention to detail, presenting the product in the way that best fits the image and direction of each client.

Artificial Intelligence for Financial Institutions

There are many different ways artificial intelligence (AI) can be used in a financial institution to improve operations.

For example, utilizing AI in financial institutions can help mitigate employee turnover by enhancing both the employee and consumer experience. Read more from FTSI’s Senior Vice President of Innovation, Brett Wooden, in the Credit Union Times: How AI Can Help Combat the Great Resignation.

Blockchain and Cryptocurrency for Financial Institutions

The United States took a major step towards adopting a regulatory framework for the governance of digital assets, with President Joe Biden signing an Executive Order on Ensuring Responsible Development of Digital Assets in March of 2022.

Since then, a preliminary framework has been released. What does this all mean?

See What Does President Biden’s Recent Framework for the Responsible Development of Digital Assets Mean for Financial Institutions? By FTSI’s Chief Technology Officer, Travis Hoban.

For those looking to learn foundational aspects of blockchain and cryptocurrency, FTSI’s Blockchain Learning Series is available to watch on demand. In this series, our experts cover the basics of blockchain, crypto, Web3, and the metaverse in short, digestible presentations.

Part 1 | Blockchain & Crypto 101

Part 3 | Blockchain Identity & Security

Part 4 | Banking in the Metaverse

Want one-on-one help from our blockchain and crypto expert?

Learn more about FTSI’s Blockchain Consulting Services here >>

Banking in the Metaverse

The metaverse is a 3D integrated network of virtual worlds that is increasingly attracting the attention of major corporations looking to make a digital appearance in front of billions... and financial institutions are starting to take notice.

Union Bank of India recently launched a virtual lounge in the metaverse, where people can enter the lounge to access available banking services such as social security, loans, and other banking products, as if they were physically in a branch.

Other banks that have made an appearance in the metaverse but are not necessarily offering full banking services (yet), are JPMorgan Chase and HSBC.

Presented by Brett Wooden, Senior Vice President of Innovation | FTSI

With limitless uses for the metaverse and more people logging on every day, financial institutions have a unique opportunity to enter this digital space to establish a presence and educate their consumers.

Learn more about banking in the metaverse with these resources:

How the Metaverse Can Help with Financial Education: Part 1

How the Metaverse Can Help With Financial Education: Part 2

Blockchain Learning Series Part 4: Banking in the Metaverse

Digital Consulting for Banks and Credit Unions

Financial institutions looking to implement digital solutions may seek out consulting services to understand the current industry's landscape, audit competitors and current practices, ensure compliance, plan for software migrations, and more.

FTSI offers an array of consulting services for financial institutions using Design Thinking. These services include:

Digital Assessment | Take a deep dive into your current environment as well as your competitors' to help understand your position from a consumer's lens. Audits and recommendations on digital products to enhance both member experience and customer-facing roles.

Marketing and Branding | Creation or refresh of your positioning statement, brand colors, logos, customer bases and personas, branding guidelines, and overall marketing strategy to grow and retain your customer base.

App Design | Explore the creation of a custom mobile app for your financial institution. Bring your ideas to life using the "4 D’s" - Discovery, Design, Development, and Deployment. App design consulting should include recommendations on how to market and sell your app.

Core Conversion and Digital Modernization | Develop a plan for modernizing and receive recommendations for best-of-class partners for core conversion.

Business Case Analysis/Feasibility Study | Understand how to create and run a NeoBank, and if it's a right fit for you.

CUSO Consulting - Set up and manage a CUSO.

Other Resources for Financial Institutions

Supporting content

Contributors:

Maddy Fitzgerald

Content & Digital Marketing

Jenny Peel

VP Strategic Partnerships & Business Development

From Our Blog

Stay up to date with what's new in fintech for banks and credit unions.

What Financial Institutions Need to Know About ATM Fraud in 2025

Why Hard Disk Encryption is a Must in the Age of ATM Jackpotting

.png?width=975&height=488&name=Blockchain%20Learning%20Series%20(2).png)

.gif?width=975&height=488&name=Digital%20Pillar%20Page%20-%20How%20to%20Be%20a%20Digital-First%20FI%20in%202023%20%20(1).gif)

.gif?width=975&height=488&name=Digital%20Pillar%20Page%20-%20How%20to%20Be%20a%20Digital-First%20FI%20in%202023%20%20(2).gif)