Share this

Blockchain and Crypto for Financial Institutions: A Short Guide

by Admin

.png?width=1097&height=549&name=Blog%20Article%20Featured%20Images%202023%20(7).png)

Blockchain technology and cryptocurrency have been buzzwords in the finance industry over the past few years, with increasing interest and adoption of these innovative technologies by financial institutions all over the world.

Table of Contents

What is Blockchain Technology?

The Impact of Blockchain on Financial Institutions & Their Consumers

Additional Use Cases for Blockchain in Financial Institutions

Crypto and The United States Government

The Impact of Crypto on Financial Institutions

Benefits of Blockchain and Crypto Adoption for Financial Institutions

Blockchain Consulting Services for Financial Institutions

Crypto Consulting Services for Financial Institutions

Welcome to The Basics of Blockchain & Crypto for Financial Institution Professionals

Blockchain technology offers numerous benefits, including increased security, transparency, and efficiency, while cryptocurrency is a digital asset that has gained attention for its decentralization and potential to transform traditional financial systems.

Let's explore the basics of blockchain technology and cryptocurrency, their impact on financial institutions, the potential benefits of their adoption, and how to get started.

What is Blockchain Technology?

Blockchain technology is a distributed ledger technology that enables secure and transparent transactions between parties without the need for intermediaries. It is a decentralized system where data is stored in a chain of blocks that are linked together using cryptographic techniques. Each block contains a set of transactions and a unique cryptographic hash that links it to the previous block, creating a tamper-proof and immutable record.

In addition to enabling secure and transparent transactions, blockchain technology has the potential to revolutionize the way financial institutions operate. By eliminating intermediaries, blockchain can reduce transaction costs, improve efficiencies, and increase trust in the financial system.

Blockchain technology can be used by financial institutions in a multitude of ways, including facilitating cross-border payments, enabling faster settlement times, and increasing financial inclusion by providing access to financial services for underbanked populations. As the financial industry continues to evolve, blockchain technology will likely play a significant role in shaping its future. Now is the time for banks and credit unions to explore their options and consider adopting blockchain technology.

The Impact of Blockchain on Financial Institutions and Their Consumers

The adoption of blockchain technology has the potential to revolutionize the financial industry, bringing significant benefits in terms of security, transparency, and efficiency. The decentralized nature of blockchain allows for faster and more secure transactions, eliminates intermediaries, reduces costs, and increases trust in financial transactions. Financial institutions are currently exploring and adopting the use of blockchain in various areas, such as trade finance, remittances, and supply chain management.

Consumers benefit from blockchain technology in several ways. The decentralized architecture ensures that there is no single point of failure or vulnerability, making it nearly impossible for bad actors to compromise the system.

Transactions can be executed faster and at lower costs, as intermediaries are eliminated. This translates to faster and cheaper remittances, lower transaction fees, and ultimately, more money in the pockets of consumers.

The transparency and immutability of blockchain provides an extra layer of protection against fraud and other financial crimes, further increasing consumer confidence in the financial system.

It can also help financial institutions streamline their operations, leading to more efficient services for consumers. For example, blockchain can be used to improve title, escrow, and insurance processes, to name a few. This, in turn, leads to lower costs for the financial institution, which can be passed on to consumers in the form of lower prices or fees.

Overall, the adoption of blockchain technology by financial institutions can lead to significant benefits for consumers, including increased security, transparency, efficiency, and cost savings.

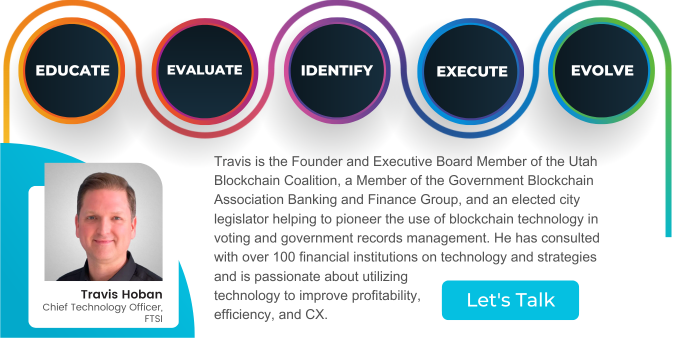

Watch On Demand: Blockchain & Financial Services Virtual Panel

This webinar covers how blockchain can improve the efficiency, transparency, and security of financial transactions, and its potential for transforming services including payment systems, lending, and asset tokenization. Additionally, explore use cases and hear about the future of blockchain, the rise of central bank digital currencies (CBDCs), Decentralized Finance (DeFi), and their potential impact on the industry.

Our expert speakers include

Eric Guthrie, Esq. | Partner, The Cogent Law Group

Becky Reed | Chief Executive Officer, Lone Star Credit Union

Travis Hoban | Chief Technology Officer, FTSI

Additional Use Cases for Blockchain in Financial Institutions

While blockchain technology is primarily associated with transaction processing and record-keeping, it also has several non-transaction related use cases that can benefit banks and credit unions.

One way is using it for identity verification and management. Blockchain technology can provide a secure, decentralized way of verifying and managing user identities, reducing the risk of identity fraud and making it easier for customers to access financial services.

Blockchain technology can also be used for compliance and risk management. Banks and credit unions can use blockchain to create secure, tamper-proof records of compliance activities and risk assessments, making it easier to demonstrate regulatory compliance and reducing the risk of penalties or fines.

Finally, blockchain technology can be used for voting and shareholder management. Blockchain-based voting systems can provide a secure and transparent way for shareholders to cast their votes, reducing the risk of fraud and improving the accuracy of vote counts. Blockchain-based shareholder management systems can also make it easier for companies to manage their shareholder records and communicate with their shareholders.

What is Cryptocurrency?

Cryptocurrency is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. The most well-known cryptocurrency is Bitcoin, which was created in 2009, and now there are thousands of other cryptocurrencies available in the market.

Cryptocurrencies have become increasingly popular as an alternative to traditional currencies, with some even seeing them as the future of money. They offer several potential advantages to financial institutions and their customers, including fast and secure cross-border transactions, reduced transaction fees, and increased financial privacy.

Cryptocurrencies also provide financial institutions with the opportunity to expand their customer base and reach a new, younger demographic. However, the adoption of cryptocurrencies is not without challenges, such as regulatory uncertainty, volatility, and security concerns. Nonetheless, financial institutions should explore the use of cryptocurrencies in various areas, such as payments, investments, and asset management, and consider the potential benefits and risks of adoption.

Crypto and The United States Government

Cryptocurrency has been a topic of interest for the United States government in recent years. While the government recognizes the potential benefits of cryptocurrency, including its ability to promote financial innovation and inclusion, it also has concerns about its use in illicit activities such as tax evasion, money laundering, and ransomware attacks.

As a result, the government has begun to take various measures to regulate the crypto industry, including requiring exchanges and wallets to comply with Anti-Money Laundering (often referred to as “AML”) and Know-Your-Customer (often referred to as KYC) regulations, as well as issuing guidance on the taxation of cryptocurrency transactions.

In March of 2022, President Biden signed an Executive Order on Ensuring Responsible Development of Digital Assets, promoting competition in the U.S. economy. While the order covered a wide range of industries, it also included specific language on cryptocurrency. The order directed the Treasury Department to develop new rules for cryptocurrency exchanges and wallets, with a focus on increasing transparency and preventing illicit activities such as tax evasion, money laundering, and ransomware attacks.

Read More: Biden’s Executive Order on Cryptocurrencies: What Does it Mean for the Financial Industry?

The Impact of Cryptocurrency on Financial Institutions

The adoption of cryptocurrency services has the potential to transform traditional financial systems by providing an alternative to traditional currencies and payment systems.

Cryptocurrencies offer decentralization, which means that they are not controlled by any central authority, such as a government or a central bank, which is of strong interest to today’s modern consumers. This creates a level of trust and transparency that traditional currencies cannot provide.

For banks and credit unions, the adoption of crypto and crypto strategies can bring significant advantages. Financial institutions can tap into a completely new market, expand their customer base, and even position themselves as thought leaders.

Crypto services can also reduce the cost of cross-border transactions by eliminating intermediaries, such as correspondent banks, and reducing the time required for settlement. Additionally, offering crypto services can help financial institutions to stay competitive in a rapidly evolving industry and to differentiate themselves from other institutions that have not yet adopted this technology.

However, it is important for financial institutions to approach the world of cryptocurrencies with caution and to carefully consider the associated risks, such as volatility and regulatory uncertainties. Developing a comprehensive strategy for cryptocurrency adoption and risk management with a trusted professional is crucial for success in this space.

Interesting Read: What President Biden’s New “Framework for the Responsible Development of Digital Assets” Means for Financial Institutions

Benefits of Blockchain and Cryptocurrency Adoption for Financial Institutions

The adoption of blockchain and cryptocurrency has the potential to provide numerous benefits to financial institutions, including:

Improved Security > Blockchain technology provides a tamper-proof and immutable record of transactions, reducing the risk of fraud and improving security.

Increased Efficiency > Blockchain technology eliminates intermediaries, reducing costs and increasing efficiency in financial transactions.

Transparency > Blockchain technology provides transparency in financial transactions, increasing trust and reducing the risk of errors or fraud.

Accessibility > Cryptocurrency provides an alternative to traditional currencies, increasing accessibility and creating opportunities for financial inclusion.

Innovation > Blockchain and cryptocurrency are innovative technologies that have the potential to transform traditional financial systems, enabling new business models and creating new revenue streams.

Blockchain Consulting Services for Financial Institutions

FTSI offers consulting services to financial institutions looking to adopt blockchain technology. Our team of experts has extensive knowledge and experience in the areas of blockchain technology and fintech, and we are committed to helping our customers achieve their goals through the adoption of blockchain technology. We provide customized strategies based on your specific needs and work closely with your team to ensure a smooth and successful adoption process.

Crypto Consulting Services for Financial Institutions

Offering crypto services can attract a new generation of customers and provide a competitive edge in a rapidly evolving financial landscape. FTSI's crypto consulting services provide financial institutions with the expertise to navigate the emerging crypto landscape. Our expert team can guide you through the implementation of crypto products while ensuring compliance and optimal consumer experience. Contact us today to learn more about how our consulting services can help your institution embrace the future of finance.

Download the free resource > The Top 8 Cryptocurrency FAQs for Financial Institutions

Blockchain technology and cryptocurrency have the potential to revolutionize traditional financial systems, bringing numerous benefits to financial institutions and their clients. The adoption of these innovative technologies requires a strategic approach, and financial institutions should consider partnering with experts in the field to ensure a successful adoption process.

FTSI is committed to helping financial institutions achieve their innovation goals through the adoption of blockchain and cryptocurrency technologies, and we look forward to working with you to create a more secure, efficient, and innovative financial future.

Share this

- 2025 August (2)

- 2025 July (3)

- 2025 February (1)

- 2025 January (2)

- 2024 December (1)

- 2024 September (1)

- 2024 July (5)

- 2024 May (1)

- 2024 March (2)

- 2024 February (1)

- 2023 December (1)

- 2023 October (3)

- 2023 September (1)

- 2023 August (3)

- 2023 July (2)

- 2023 June (2)

- 2023 May (2)

- 2023 April (1)

- 2023 March (2)

- 2023 January (2)

- 2022 December (4)

- 2022 November (5)

- 2022 October (1)

- 2022 September (5)

- 2022 August (2)

- 2022 July (1)

- 2022 April (2)

- 2022 March (1)

- 2022 January (1)

- 2021 October (3)

- 2021 September (2)

- 2021 June (1)

- 2021 April (1)

- 2020 December (1)

- 2020 October (1)

- 2020 May (2)

- 2020 March (2)

- 2020 February (1)

- 2020 January (1)

- 2019 October (1)

- 2019 September (1)

- 2019 May (1)

- 2019 March (2)

- 2019 January (3)

- 2018 July (1)

- 2018 June (1)

- 2018 April (2)

- 2018 January (1)

- 2017 December (1)

- 2017 November (1)

- 2017 September (1)

- 2017 August (1)

- 2017 June (1)

- 2017 May (1)

- 2017 April (1)

- 2017 March (1)

- 2017 February (2)

- 2016 December (1)

- 2016 November (1)

- 2016 July (1)

- 2016 February (1)

- 2015 December (1)

- 2015 September (2)

- 2015 June (1)

- 2015 May (2)

- 2015 April (1)

.png?width=666&height=333&name=Crypto%20FAQ%20Email%20to%20Attendees%20Assets%20(3).png)

.png?width=975&height=488&name=Blockchain%20Learning%20Series%20(2).png)